Global creators’ collections up 5.8% in 2021 but still below pre-COVID levels

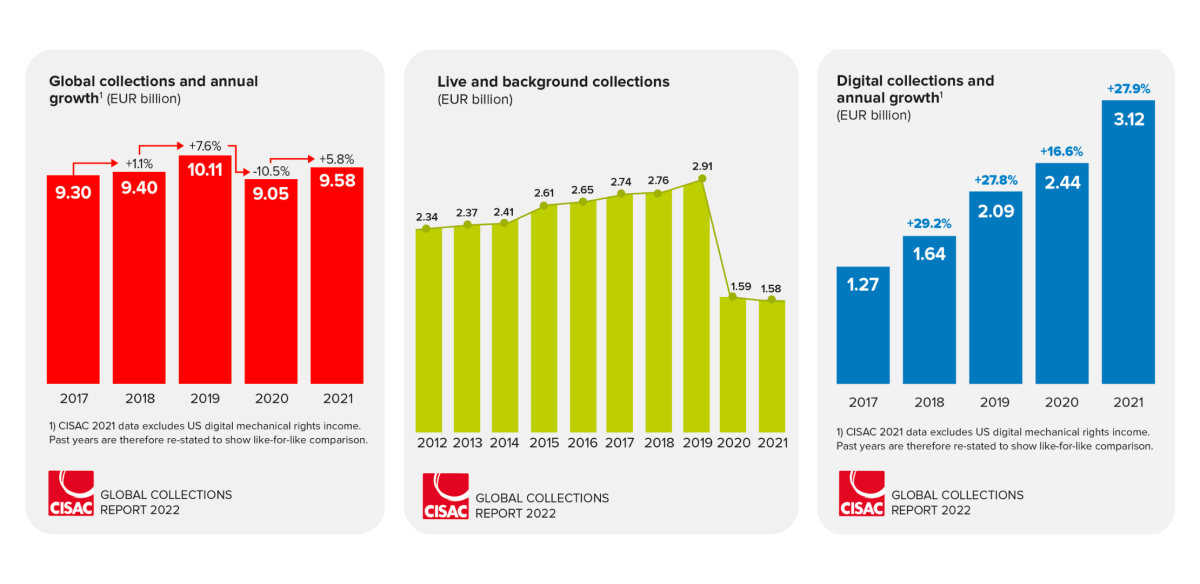

Paris, 27th October 2022 - Global royalty collections for creators of all repertoires returned to growth in 2021, rising 5.8% to EUR9.6 billion but remaining well below pre-pandemic levels.

Despite a 27.9% rise in digital royalties helped by the growth of subscription streaming, total worldwide collections in 2021 were still 5.3% lower than in 2019.

The result illuminates the disastrous impact of the two-year lockdown on live and public performance income, the potential for further digital growth and the urgent need for actions to unlock more value for creators in the streaming market.

These are among the key highlights of the 2022 Global Collections Report published by CISAC (International Confederation of Societies of Authors and Composers). The report provides comprehensive data and analysis of collections across all repertoires including music, audiovisual, visual arts, literature, and drama.

Key numbers:

- New and extended digital licensing deals by CISAC member societies, coupled with streaming and subscription growth, helped digital collections to increase by 27.9%. However, despite the shift to streaming, which accelerated under COVID, digital still makes up only 32.6% of all royalty collections – less than half the share accounted for by digital in the recording industry.

- Revenues from live and background uses stayed flat in 2021 at EUR1.6 billion but were still 45.8% below their pre-pandemic total of EUR2.9 billion in 2019.

- Income from TV and Radio, creators’ largest royalty stream, remained relatively robust through the pandemic but saw a slight decline of 1.8% in 2021.

- Music was the only repertoire reporting increased royalties in 2021, with growth of 7.2%. The drama sector, most vulnerable to lockdowns, saw royalties down 13.8%. Audiovisual collections declined by 2.8%, literature by 3.9% and visual arts by 1.2%.

- Europe and Africa saw the largest collections growth, up 7.5% and 17.1% respectively. Latin America was the only region to decline in 2021, with a 44% fall in live and public performance collections.

Download the Key Highlights of the Global Collections Report here.

Download 2021 Market Analysis here. The COVID crisis has transformed the shares of live/public performance and digital.

Download Society case studies: Reporting on how CISAC societies in 8 countries are serving creators and maximising remuneration via technology services, lobbying and licensing.

Quotes

CISAC Director General Gadi Oron: “After the 10% fall experienced in 2020, our societies’ return to growth last year is an impressive achievement. Bearing in mind that income from live concerts and public venues was largely non-existent, the acceleration of digital licensing by many of our members to offset the decline in other areas is a real success story. The recovery is only half done, though. There is, without a doubt, much more room for growth, and to achieve that, we need to bring more value to creative works in the digital market and promote a fairer ecosystem for creators.”

CISAC President Björn Ulvaeus: “Digital royalties collected by CISAC societies are growing impressively, but the streaming world is still unfinished business when it comes to ensuring a fair environment to earn a living. Too much of the data needed to identify and remunerate creators is incomplete or missing when works are ingested on streaming services. The result is a lot of money that is left on the table when it should be going into creators’ pockets.”

CISAC Board Chair, Marcelo Castello Branco: “We need to see this year not just as a return to normality, but as a bridge to the next phase. In the near term, we face the prospect of economic slowdown ahead and the risks that come with the unusual combination of inflation and recession. Subscription prices are already undervalued and need to be raised, with prices having barely changed since the early days of the streaming model. Fair value and fair terms are essential so as not to compromise the remuneration of rightsholders.”